What does responsiveness mean in the contemporary landscape?

What does responsiveness mean in the contemporary landscape?

In the digital landscape, companies and consumers alike are accustomed to lightning-fast speeds.

Whether it is for their information, their communication, or their products, instantaneous responses are the norm and have become the expectation.

Responsiveness is more than just being able to respond to changes in demand and supply within the market. In the highly competitive global marketplace, it also means being able to distinguish your company from the millions of other organisations out there, competing for the same position in the industry, resources and market share.

The quicker you can respond to the needs, values, and expectations of your consumers, the more sustainable the success you build in both the short and long term.

This means that your responsiveness must become part of your strategic goals to success, instead of just a dormant area of business operations.

How can your finance function influence your responsiveness?

How can your finance function influence your responsiveness?

The pressure is always on finance, no matter what form business optimisation may take. Every business process and strategy is dependent on your financial actions.

In the current market, transparency in your financial operations is facilitated through the digitalisation of your financial processes and Finance 4.0 techniques. More transparent operations help you maintain a better and healthier dialogue with your stakeholders, automatically improving your responsiveness in their eyes and the ability to gauge what your stakeholders’ priorities may be.

Practically and strategically, your finance function is also responsible for the efficient allocation of resources and investments to ensure that every segment of your business operations is running smoothly.

If your resources are not utilised properly, it will hamper your company’s ability to form a timely response to the market you operate in.

Maintaining your responsiveness is more than just knowing what your stakeholders need; it is also being able to anticipate their needs and respond on a timeline that meets their expectations.

Finance plays a critical role in facilitating this process.

Keeping up with the market

Keeping up with the market

Your responsiveness today does not necessarily mean that your business will remain swift in the months, or even the weeks and days to come.

The competition in the current market is always rising, and becoming complacent with your business success, or the processes you have in place, are a surefire way to fall behind.

Consistent optimisation is a necessity to survive for any business. The challenge of staying up to date is constant, but support in the form of professional finance advisory on a regular basis can make the process of continuous improvement easier and more strategic.

This means embracing financial advisory as a routine; an internal process rather than an external intervention committed to on specific occasions.

When you embrace the input of financial advisory, you also make way for the transformative power it can have on your business.

Your financial consultant can deliver targeted value and strategic insights, but they can also introduce a culture of continuous improvement to your business model and increase your internal responsiveness to the changes they bring

The value of finance advisory

The value of finance advisory

In the age of information, what unique value can a financial advisor bring to your business that you cannot generate internally?

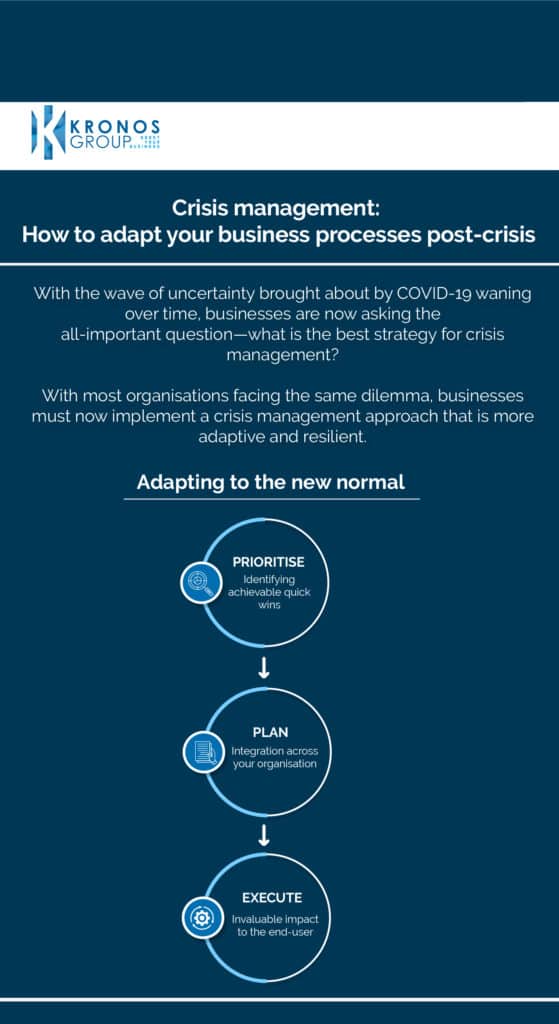

Financial consulting and advisory have often been leveraged during times of crisis or when a business is undergoing rapid change and exploring new opportunities. This is because financial advisory provides you with the information and insights you need to make strategic changes to your finance function.

A specialised finance advisor will also analyse your company from the inside out, understand your efficiencies and your goals to deliver targeted, strategic insights to help you transform your operations.

They enable this transformation through sustainable methodologies, such as identifying and implementing the right frameworks for you, as well as through continuous value addition including training programmes for your teams.

Additionally, financial advisory is helpful in a crisis or when your company needs to enact swift change because they are able to deliver this value on an accelerated timeline. Their experience in the field, and in optimising other companies in a similar industry to your own, means that the changes they bring are swift as well as accurate. This allows them to mitigate the risks involved in most business transformations.

Because a finance advisor is an external presence, they are also able to take a step back from your organisational culture and bring in new ideas and perspectives to drive your transformation.

Their position as an external professional is also likely to encourage hesitant team members to accept these changes and embrace continuous improvement.

There is no secret formula to business success and no single solution that can ensure it. Often, companies must leverage a mix of different solutions, processes, and technologies in order to drive the results they want to see.

Customer expectations are also rising on a daily basis, which means that responsiveness is more vital than ever before; this responsiveness and desire to showcase the values customers care about may have a greater influence on a company’s success than lower prices.

It is important to note, here, that responsiveness does not mean bending to every trend. Not only is this unsustainable but it will also lead to wastage of your resources. A company’s internal operations and stakeholders require as much stability as possible, especially in a volatile market.

Balancing responsiveness with reliability, while staying true to your core values, is a balancing act that timely advisory can help you maintain.

Stay prepared for the future while meeting the priorities of the present with finance advisory.

How we support your success

How we support your success

We know that finance advisory, alone, cannot spell success for a business of any type or function.

That is why, here at Kronos Group, we offer a range of higher value-added support services that not only help you achieve your short and long-term financial goals, but also help you take an integrated approach to business transformation and optimisation.

These specialised services range from professional consulting and advisory to:

Sustainable digital frameworks

Spend management platforms

Support in spend optimisation

Swift maturity assessments

Industry 4.0 techniques

Specialised outsourcing services

Training and people development resources

To discover how our team of dedicated professionals can help you improve your responsiveness to the current competitive market, get in touch with us or email us at info@kronosgroup.eu.